Mobile wallet apps are now popular in India as a one stop solution for recharges and bill payments. They also have a facility to instantly send money to peers, and avail cashback, discount offers at third party merchants.

Though all these wallet apps seem similar at first glance, each one is special in their own way. Plus, each of them may have an exclusive offer that you might want to avail at some point of time. In this article, we’ll explore a few of the popular wallet apps available in India.

FreeCharge

FreeCharge was first started in August 2010 by Kunal Shah and Sandeep Tandon. The initial idea of the website was to make mobile recharges virtually free by providing discount coupons and other offers of equivalent worth, from partner brands. They now support a variety of recharges and bill payments, including mobile, DTH, data card, land line, electricity, gas, etc. It also supports Mumbai Metro Smart Card recharges. Additionally, you can also request money from or send money to other FreeCharge users instantly free of cost.

From time to time, you can also avail attractive cashback offers from several of the partner merchants, which includes brands like McDonalds, Dominos, Cafe Coffee Day, Baskin Robins, and more.

Exclusive Features

– Pay merchants using FreeCharge money: FreeCharge allows users to make payments at specific merchant outlets using your wallet balance. At any supported outlet, just provide your FreeCharge registered mobile number and enter the four digit PIN displayed within the app (via the Pay Merchants option) to verify and complete the payment.

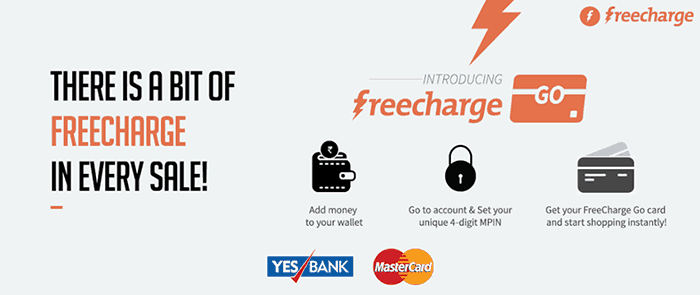

– Virtual Master Card: FreeCharge allows its users to create a virtual Yes Bank Master Card which can be used to pay online at any e-commerce payment gateway supporting Master Cards.

MobiKwik

MobiKwik is another wallet app that offers in-app mobile, DTH, data card recharges and utility bill payments including landline, electricity, gas, water. It even allows you to pay your insurance premium (for select vendors) from within the app. Like other similar services, it also allows you to instantly transfer money to other MobiKwik users for free. Users can also avail special offers and discounts from partner merchants after completing a recharge transaction.

Exclusive Features

– Earn and redeem Payback points: If you are a Payback user, you can earn points for transactions on MobiKwik app or website. You can also redeem your Payback points into your MobiKwik wallet and use them for recharges and bill payments.

– Cash Pickup and Deposit: For those who still prefer cash payments, MobiKwik offers a special cash pickup and deposit service at select cities, where the user can opt for a cash payment for adding money to MobiKwik wallet.

– Play and Earn (I’m Feeling Lucky): You can try your luck at a virtual slot machine for a chance to win exclusive cashbacks in forthcoming MobiKwik transactions.

Paytm

Paytm is probably the most popular wallet platform in this list. It offers mobile, DTH, data card, Metro Smart Card recharges (Delhi and Mumbai) along with electricity, gas, water and landline bill payments. Additionally, Paytm also offers payments for Insurance, Gold Loan, Education, etc., many of which are exclusive to the service.

Paytm features a Wallet facility, which allows users to add, send or receive money instantly among themselves and other Paytm users. Users can also avail special offers and discounts from partner merchants.

Exclusive Features

– Native Online Store: Paytm has an e-commerce store of its own, where you can use your Paytm money to make your purchases.

– Payments for Educational Institutions: Now you can pay fees in different institutions using Paytm. Some of the renowned institutions supporting Paytm include Aakash Institute, CETPA Infotech Pvt. Ltd, ICA, IEC College and University, Delhi Public School, etc.

– Exclusive offers and integration with partner brands: Paytm has very good integration with its partners and usually offer more discounts compared to other similar services. It is often featured as a direct payment method in some third party apps like Uber and Foodpanda (including cashback offer).

– Travel and Entertainment bookings: Paytm has recently introduced in-app payments for bus tickets and hotel bookings. You can also book movie tickets in specific cinemas using the app or website.

– Upgrade wallet for a higher transaction limit: You can request for a wallet upgrade to support transactions up to ₹1,00,000 per month. For this, you need to update your KYC details at Paytm for verification. You can either schedule a pickup or visit the nearest Paytm KYC center. You are required to submit any one RBI approved proof of address and any one RBI approved proof of identity.

Buddy

SBI Buddy is a wallet app from State Bank of India that allows any user (including non-SBI customers) to perform mobile, data card, DTH recharges along with various utility bill payments. Additionally, SBI customers can avail special discounts at specific online merchants with the State Bank Rewardz Loyalty Program, which is integrated within the app.

Exclusive Features

Though SBI Buddy is similar to other wallet services in many ways, it does have a few exclusive features.

– Fee-less transfer from Buddy Wallet to Bank account: Transfer to bank is supported by most wallet apps, but almost all of them include a certain transaction fee. But using SBI Buddy, you can transfer your buddy wallet balance directly into your bank account (up to ₹2,000 per transaction and ₹20,000 per month). You can learn more about this feature in this article.

– Maximum Utility Billers: SBI Buddy includes a host of billers for utility bill and insurance premium payments. It is unique in the way that it provides bill payment facility for more government billers compared to any other wallet app.

Pockets

Pockets, from ICICI Bank is a wallet app that a customer of any Indian bank can use to recharge mobile, send money, pay bills, shop at partner outlets, avail great deals and more. Most of its features are similar to other wallet apps, but it does have one cool exclusive feature.

Exclusive Features

– Physical Wallet Visa Card: Pockets allows users to issue a special Visa Card which carries the balance of your Pockets account. The card can be swiped to make payments at all payment outlets that support Visa, just like a normal debit or credit card.

Other Mobile Wallet apps

Apart from these wallet apps, there are several other wallet services available for smartphones. Most of these have a similar list of features, which includes mobile, DTH, data card recharges, utility bill payments and instant transfer of wallet money among peers.

PayUMoney is more of a payment option rather than a traditional wallet app. While shopping at supported online merchants, users can select PayUMoney as the payment method and then choose a preferable mode of payment (Debit/Credit card, NetBanking, etc.). Doing so, they can avail various special offers, cashback deals, discounts and guaranteed 1% extra discount or reward points on every transaction. Any refund or cashback amount is instantly added to PayUMoney wallet, where it can be used for recharges and bill payments.

PayUMoney also allows users to make fee-less transfer of wallet money to bank account, but there are a few restrictions. Each transaction has to be within the ₹500 – ₹5000 limit, and the money should remain in the wallet for at least 7 days before you can request a cash out. Depending on the bank, the money may take around 5-7 business days to get credited to your account.

Some other wallet apps with similar features include PayZapp (From HDFC), Oxigen Wallet, MyAirtel (Airtel Money), etc. If you’re an Airtel customer, you can recharge using MyAirtel app and avail exclusive offers on recharges.

A New Era of Cashless Payments

In India, it has taken a considerably long time to embrace online payments as the norm. People were generally skeptical about sharing bank related information online, and wouldn’t easily trust a third party app or website for cashless payments.

One of the primary hassles of online transactions that caused discontent among users, is how failed transactions are handled. In case of a transaction failure, it usually takes 5-7 business days to refund it to your bank account. Apps like Paytm and FreeCharge introduced the wallet concept as a solution for instant refunds. In case of failed recharges, instead of waiting for money to be credited to one’s bank account, it’s instantly available in their virtual wallet. That money could then be used for other recharges or bill payments.

Eventually, these wallets started rolling out features for instantly transferring funds among peers, and even transfer the money to the bank account. Along with that, these services also started collaborating with partner brands, making external third party payments possible via wallet money.

Moreover, virtual wallets tend to make online payments a hassle-free experience. For example, you don’t need to login every time you’re making a payment. The security is lower compared to banks, but your wallet money is also limited and completely isolated from the actual bank account. And when making online payments using these virtual wallets, you don’t need to share your actual bank details. This fact might have contributed to making users feel more confident about participating in online transactions.

Finally, wallet apps also offer cashbacks and discounts with third party brands; hence encouraging users to use wallet money in various online transactions, converting them into dedicated wallet users.

Nowadays, more companies, including many private and public sector banks, are launching their own wallet apps, encouraging more users to involve in cashless transactions. Cashless transactions would, in turn, reduce unnecessary printing of banknotes, which might help in improving the country’s economy in near future.