Transferring funds (in India) via NetBanking usually takes place in three different forms — NEFT, RTGS and IMPS. Depending on the type of transaction, banks often charge a certain fee for interbank funds transfer, which gets deducted from the sender’s account every time such a transaction takes place. This fee may be nominal for large transactions. But for frequently performed smaller transactions, such fees might add up to a significant amount.

In this article, we’ll explore how to transfer funds between different bank accounts (in India), without being charged of any transaction fees.

SBI Buddy is a mobile wallet app released by State Bank of India, which allows users to add funds to their Buddy account and let them spend on mobile recharges and online shopping at various partner brands. Among all these features, which are quite common in several of the wallet apps these days, there’s one which is particularly exclusive to Buddy app as of now. That special feature is fee-less instant fund transfers from Buddy wallet to any bank account via IMPS.

Note: The fee-less transfer to bank facility is being discontinued w.e.f. 1st June, 2016. After the deadline, a 3% fee will be applicable on all bank transfers using the SBI Buddy app.

IMPS fund transfer without any transaction fees

Follow the steps below to transfer money instantly from one bank account to the other with no transaction fee:

- Download and install State Bank Buddy app on your iOS or Android device.

- Launch the app and register / log in to your Buddy Account.

- Once logged in, tap on Add Money.

- Enter the amount you want to transfer and choose the Net Banking or Debit Card option.

- Once the transaction is completed, the required funds will be added to your Buddy wallet.

- Next, tap on the hamburger icon in the top left corner to reveal the app menu, and select ‘Transfer To Account’ option.

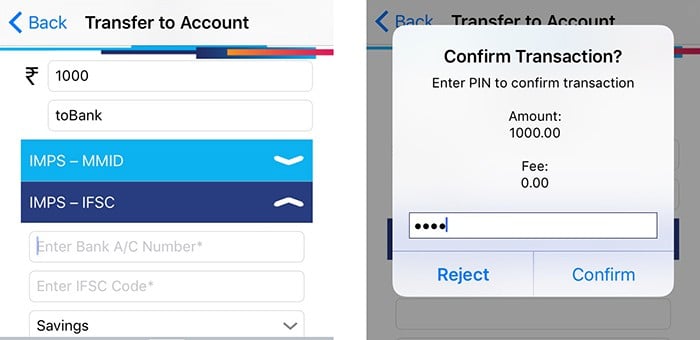

- Enter the amount you want to transfer and choose the IMPS mode of preference (IFSC or MMID).

- Enter the recipients details and tap Continue. You will be prompted to enter your registered PIN.

Once the PIN has been verified, the mentioned amount should instantly be transferred to the recipient’s account and no additional transaction fees are charged.

Benefits of using Buddy for funds transfer

Instant funds transfer is one of the key features of the SBI Buddy app, but it can also be useful for transferring funds in certain unique situations.

Transfer funds without adding beneficiary : Sometimes, you may wish to instantly transfer funds to someone who is not in your beneficiary list. Depending upon the bank, you might have to wait up to 24 hours in order to add them as beneficiary before transferring funds. Moreover, if you intend to send money to people as a one-time activity, you might not prefer to add them as beneficiaries at all. In such situations, SBI Buddy is a handy alternative for instant funds transfer.

Instant funds transfer without NetBanking (with Debit Card) : IMPS funds transfers are usually initiated through NetBanking or Mobile Banking portals. But if you haven’t registered for either of these services, SBI Buddy allows you to add funds to your Buddy wallet via Debit Card, and then transfer them to any bank account. Thus, you can perform an instant funds transfer even without a NetBanking account.

Send money without knowing bank details : SBI Buddy is ideal for frequently transferring money among peers, as it allows users to send money using just the recipient’s mobile number. A few other wallet apps, like Paytm, do allow such instant transfers, but the money in these wallets usually do not hold their true value. Such transfers are only effective when both the sender and receiver are active users of the same virtual wallet money.

On the other hand, one can simply use the Buddy app to receive funds, and then transfer the money to their bank accounts. Since funds transfer through SBI Buddy does not include any transaction fees, one can get the whole amount transferred to the bank with its actual value.

Even if the recipient’s phone is not registered with SBI Buddy, you can still send money using Buddy app. The recipient will then get a notification via SMS, and can claim the money by signing up for a new Buddy account. If unclaimed for 5 days, the money gets automatically refunded to the sender’s wallet.

There’s no minimum limit for transferring funds; however, you can only transfer up to ₹2000 per day and up to ₹10,000 per month from your Buddy account. Of course, Buddy app is not just meant for users who are SBI account holders; the app works with other banks just as well.

These days, many of the mobile wallet providers in India, including the popular ones like Paytm, Mobikwik, etc. do allow users to transfer money from their wallet to bank account, but with some transaction fees. For example, Paytm deducts more than 4% of the amount being transferred to the bank. State Bank Buddy, on the other hand, does not charge any fee for such bank transfers, even though it uses IMPS.

The only other digital wallet we have found that allows users to transfer funds to bank accounts without a transaction fee in India is PayUMoney. But then again, here you have a limit of ₹500 to ₹5000 per transaction, and the money needs to stay in your PayUMoney wallet for at least 7 days before it can be transferred to the bank.

So now you know how to transfer funds instantly with zero transaction fees. Let us know if you are aware of any other alternatives in the comments below.