PayPal, as most of you might be familiar with, provides an easy way to send and receive payments online. Most third party merchants support PayPal payments. The benefit PayPal provides is that you can send and receive funds from others without giving away your bank information to them.

Online payments may be carried out in many ways. Individual transactions are usually carried out after authorization via a secure portal (for example, Verified by Visa or MasterCard SecureCode). Your card is authorized every time you carry out such a transaction.

In order to make the online transaction experience smoother and hassle free, many websites and services support Auto Billing wherein you can link your card to the merchant site. Hence, whenever you make an online payment to the merchant, your card is automatically charged without the need of any further authorization. Most merchants prefer credit card over debit cards for this purpose.

Why automatic transactions require Credit Card?

Automatic transactions facilitate instant payments credited/debited directly against your account. A credit card works on a purchase now, pay later basis. This model is perfect for services involving in instant payments.

Once you have added your bank to your PayPal account, you are all set to receive payments. However, to make online payments via PayPal, there are two possible ways: make the payment through your PayPal account balance, or via a linked credit card. Now, unless you receive some credit, your PayPal account balance will stay zero. In some countries, PayPal credits are automatically withdrawn to your bank account, so there is no way to keep any money in your PayPal Account.

That leaves us only one option for making PayPal payments – via credit card. But most people in the mid 20s often do not possess a credit card. Hence, many of them face frequent problems with online purchases. On the other hand, a debit card is more commonly used. So, the question here naturally arises: Can you use a debit card on PayPal? Well, the answer is both yes and no.

Criteria for linking a debit card as credit card in PayPal

Before you go ahead and try to link your debit card to your PayPal account, make sure the following conditions are met regarding your debit card:

- Your card should be either a VISA, Master Card, American Express or Discover debit card.

- The name on your card should match with that of your PayPal account.

- The bank issuing your card should support third party automatic transactions. In India, only some banks (like CitiBank and ICICI Bank) allow third party automatic transactions.

If your card fulfills the above conditions, you are all set to link your debit card to PayPal.

Steps to link your debit card in PayPal

- Log in to your PayPal account.

- Go to Profile >> Link/Edit Credit Card.

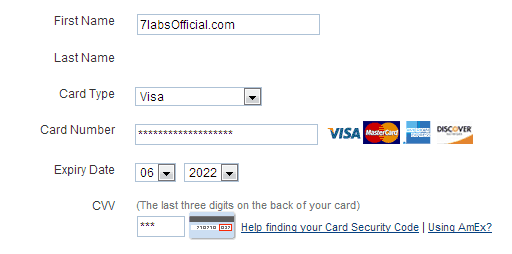

- Provide your Debit Card details in the form presented on the page (Card Type, Card Number, Expiry date, Name on card and CVV/CVC).

- Some money will be charged against your card for authorization. This money shall be refunded to your account within 3-5 business days.

- To verify your Debit Card for PayPal transactions, you will be asked to enter a 4 digit PIN code. Click on verify your credit card. Obtain a copy of your bank statement, either online or from the ATM/Bank. There will be two transactions from PayPal. One of them will contain a Transaction ID similar to PPXXXXCODE. Copy the digits XXXX and paste it in the verification window.

Soon, you will receive a notification that your card has been verified. You can henceforth make online payments via PayPal on supported sites using your Debit card.